Direct Debit

API Corporate pay bill is service to pay goods and services for corporate like utility bills, invoice payments, etc. The company sends billing instructions via API for payment quick, easy and safe to the biller.

Use Case for Direct Debit Registration

Krungsri provide new Payment Gateway direct debit to e-commerce partners. To have ability to receive direct debit payment real-time from registered BAY accounts via existing registration 4 channels (Branch, ATM, krungsri app, LOC).

“Online Direct Debit Registration” To have ability to receive direct debit payment real-time from registered BAY accounts via krungsri app, ATM channels. Biller can deduct BAY account real-time on biller’s application and web-view.

Online Direct Debit RegistrationThis feature provides a customer with authentication options to complete online direct debit registration via 2 channels.

- krungsri app

This option allows customer to authenticate identity by krungsri app PIN

- Krungsri ATM (ATM)

This option allows customer to authenticate identity using personal and BAY ATM / Debit Card information.

- Direct Debit Registration with Krungsri app (KSA)

- Direct Debit Registration with Krungsri ATM(ATM)

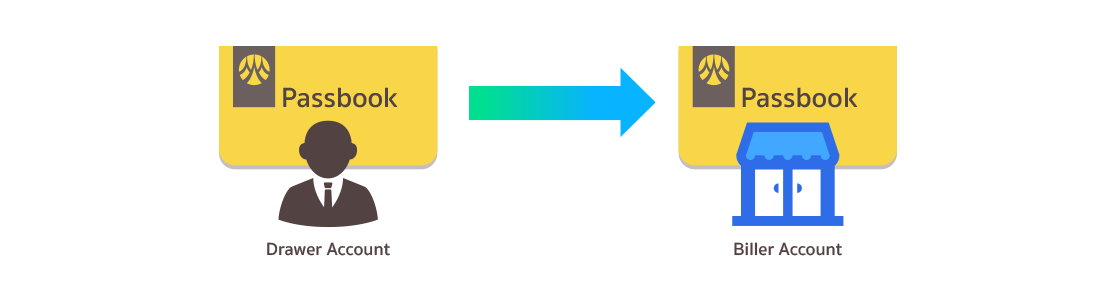

Use Case for Direct Debit Transaction

This feature provides partners to generate charge direct to payer’s account via API Transaction feature enables e-commerce partners to design their own customer experiences in order to provide customized journey to their customers

- Drawer generates request transaction using Cashlink or API.

- BAY automatically debits the payer's account.

- BAY transfers money to biller account and notify the result of the transaction.

User journey Direct Debit Transaction

.png)

- An application submits request using Register Prepare API, then oauth_context_id will be returned.

- An application submits request using Register Authorize API, then URL will be returned to redirect to BAY webview.

- Navigate user to BAY webview.

- Instruction will be sent to backend system for process register transaction

- If transaction is success, a paymentToken will be provided as a unique reference for registration.

- If transaction fails, and error code and description will be returned for reference.

- The Backend Callback API can be used to callback registration information to partner then will be returned a response with http status

- An application submits request using Get KMA Deep link API, then KMA deep link will be returned.

- Navigate user to KMA Application.

- Instruction will be sent to backend system for process register transaction

- If transaction is success, a paymentToken will be provided as a unique reference for registration. paymentToken will be uses as a mandatory for payment transaction request.

- If transaction fails, and error code and description will be returned for reference.

- After complete registration process, KMA application navigate user to Partner Application

- An application submits request using Register Prepare API, then oauth_context_id will be returned.

- The Backend Callback API can be used to callback registration information to partner then will be returned a response with http status.

- This API can be called after transaction was made, and there is a need to send additional advice to specified recipients.

- An application submits request using Register Inquiry API.

- An application submits request using Cancel Register API.

- An application submits request using Get KMA Deep link API, then KMA deep link will be returned.

- An application submits request using Register Prepare API, then oauth_context_id will be returned.

- An application submits request using Register Authorize API, then URL will be returned to redirect to BAY webview.

- Navigate user to BAY webview.

- Instruction will be sent to backend system for process register transaction

- If transaction is success, a paymentToken will be provided as a unique reference for registration.

- If transaction fails, and error code and description will be returned for reference.

- The Backend Callback API can be used to callback registration information to partner then will be returned a response with http status

- An application submits request using Get KMA Deep link API, then KMA deep link will be returned.

- Navigate user to KMA Application.

- Instruction will be sent to backend system for process register transaction

- If transaction is success, a paymentToken will be provided as a unique reference for registration. paymentToken will be uses as a mandatory for payment transaction request.

- If transaction fails, and error code and description will be returned for reference.

- After complete registration process, KMA application navigate user to Partner Application

- An QR Parser API to be used to determinded QR type and identify information.

- Payer generates request transaction using Open API (QR Transaction Initiation)

- Biller and payment information will be included in the QR string being used

- Additional information will still be required such as payer account information and associated technical details for calling an API

- Validation will take place which may include input fields, payer, and biller information validation. If transaction fails at this step, information will not be recorded in the system.

- Instruction will be sent to backend system for initiating a transaction with biller

- If initiation is successful, a paymentReferenceIdentification will be provided as a unique reference for this transaction. An Inquiry API can be called from this point onwards to fetch transaction status

- If initiation fails, an error code and description will be returned for reference

- An inquiry API can be used to inquire transaction status

- This API can be called after transaction was made, and there is a need to send additional advice to specified recipients.

• Related API

Technical Detail

Sample of request message can be as following

Request parameter : Direct Debit Registration

| paymentTokenStatus | Start create date. endCreateDateTime is required if startCreateDateTime is provided. All transactions under the range of specified startCreateDateTime and endCreateDateTime will be returned. Expected format in RFC3339. For example, YYYY-MM-DDThh:mm:ssZ (UTC) or YYYY- MM-DDThh:mm:ss+07:00 (TH Time zone) |

| drawerAccountNumber | String of characters (mainly numbers) used to identify an end-user account for transferred (sender). Expected valued is 10- Numeric value to represent end-user’s account number. |

| startCreateDateTime | Start create date. endCreateDateTime is required if startCreateDateTime is provided. |

| endCreateDateTime | End create date. startCreateDateTime is required if endCreateDateTime is provided. |

| journeyIdentifier | UUID that generated from Microsite (oauth_context_id)or Online channel (system generated). |

Sample request : Direct Debit Registration

{"paymentTokenStatus": "ACTV", "drawerAccountNumber": "7770011555", "startCreateDateTime": "2020-08-15T00:00:00+07:00", "endCreateDateTime": "2020-08-16T00:00:00+07:00", "journeyIdentifier": "68c971e1-6652-48f9-af3a-0f6c70bde952" } |

Request parameter : Direct Debit Transaction

| paymentTokenStatus | Start create date. endCreateDateTime is required if startCreateDateTime is provided. All transactions under the range of specified startCreateDateTime and endCreateDateTime will be returned. Expected format in RFC3339. For example, YYYY-MM-DDThh:mm:ssZ (UTC) or YYYY- MM-DDThh:mm:ss+07:00 (TH Time zone) |

| transactionIdentification | unique identification (UUID) to identify direct debit transaction |

| creditorAccountNumber | String of characters (mainly numbers) used to identify a partner account for transferred. |

| payerInformation | Payer's information. |

| payerInformation.paymentToken | Reference surrogate value of the account number. |

| transactionInformation | Transaction information |

| transactionInformation.transactionType | Identifier of transaction type |

| transactionInformation.re ferenceNumber1 | Reference issued by a party to identify an instruction, transaction or a message |

| transactionInformation.re ferenceNumber2 | Reference issued by a party to identify an instruction, transaction or a message |

| transactionInformation.pa ymentInstrument | Type of payment instrument |

Sample request : Direct Debit Transaction

{

“transactionIdentification”: “071f2a78-a77b-4e45-91ba-4bd96d5bcde9”,

“creditorAccountNumber”: “0457262823”,

“payerInformation”: {

“paymentToken”: “06252dbc-0a4c-437f-b718-f2aa836b10b3”

},

“transactionInformation”: {

“transactionType”: “REALTIME”,

“referenceNumber1”: “REF1”,

“referenceNumber2”: “REF2”,

“paymentInstrument”: “DDEB”,

“paymentAmount”: 5000.00,

“annotation”: “This is remark for this transaction”

}

}

|